Encompass Home Health and Hospice, which is a segment of HealthSouth (NYSE: HLS) and one of the nation’s largest home health providers, is sounding the alarm over a recently proposed rule that would overhaul the Medicare payment system and possibly drive some providers’ margins into negative territory.

The July 25 proposal from the Centers for Medicare & Medicaid Services (CMS) could result in a $950 million Medicare payment cut for home health providers in calendar year 2019 if it isn’t implemented in a budget-neutral way, the federal agency estimated.

That proposal hinges on a new home health groupings model (HHGM) payment framework, which would swap the current 60-day episode of care unit of payment for two 30-day periods while also placing patients into payment groups depending on where they fit into six categories.

After a week of mulling over the proposed rule, Encompass executives said it was riddled with “technical flaws and concerns of legal authority.” Still, the company’s leaders are optimistic a long-term solution can be achieved, they said during a second quarterly earnings call Tuesday.

Threat assessment

The groupings model, which Encompass CEO April Anthony previously called a “significant threat” to the home health care industry, nixes incentives for home health care agencies to provide more therapy for higher reimbursement rates, a practice that some in the industry say encourages fraud.

Though the rule was just proposed last week, it has already caused financial uncertainty among some of the country’s largest publicly owned home health companies, with stocks plummeting.

“We believe that in addition to the questions of statutory authority…there are also a number of substantive technical flaws in the HHGM proposal which would create a significant redistributive effect among provider types and geographic regions throughout the country,” Anthony said.

Such redistribution would create care access issues in numerous markets across the country, she added.

“Our analysis shows that there are a number of counties across the U.S. where 100% of the home health providers located in those counties would go from positive to negative margins in their home health segment under this proposal,” Anthony said.

The proposal also ignores the fact that many patients have migrated away from higher-cost skilled nursing facilities and into home-based therapy services, she said.

HealthSouth executives also questioned whether CMS could even achieve implementing the rule without Congress and if the outlined changes would disrupt access to care.

“As currently written, the HHGM would not be budget neutral and would substantially redistribute revenue between agencies in a manner that would likely result in significant disruptions and access to care for the Medicare beneficiary population,” Mark Tarr, president and CEO of HealthSouth, said during the earnings call.

We can work it out?

Despite her warnings, Anthony continued her remarks on a more positive tone.

“We’re encouraged by the spirit of cooperation and openness that we have seen from CMS under this new administration and believe that, as we did with [Pre-Claim Review Demonstration (PCRD)], we will be able to work with CMS in the coming months to address these valid issues and produce a better solution for the industry and the patients that we serve, as well as the Medicare program as a whole,” she said.

The home health care industry as a whole will likely find a way to work things out with CMS in the long run, Sheryl Skolnick, director of research at Mizuho, told Home Health Care News.

In the short term, though, it’s unclear how successful companies like Encompass will be as they push back against HHGM, she said.

“I’m not worried about them over the long term,” Skolnick added. “But it’s the early days.”

Strong earnings, big plans

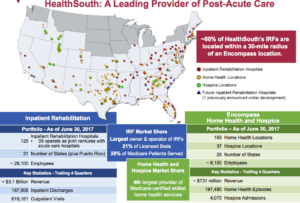

HealthSouth logged strong earnings for the second quarter of 2017. The company reported $191.3 million in net operating revenue for its home health and hospice operations, a 13.8% increase over its net operating revenue of $168.1 million in the second quarter of 2016.

HealthSouth logged strong earnings for the second quarter of 2017. The company reported $191.3 million in net operating revenue for its home health and hospice operations, a 13.8% increase over its net operating revenue of $168.1 million in the second quarter of 2016.

By year’s end, HealthSouth will spend between $50 million and $100 million on its M&A pipeline, executives said during the call.

And that plan seems to be progressing at a steady clip. Encompass Home Health and Hospice announced on July 31 it’s entering Illinois for the first time by acquiring VNA Healthtrends. HealthSouth is also focusing on beefing up its home health care portfolio in markets where it already has inpatient rehabilitation facilities.

As of mid-day trading Tuesday, HealthSouth’s stock was up more than 3.3%, at just under $44 per share.

Written by Tim Regan

Featured photo via Flickr.com/reynermedia