After President-elect Donald Trump secured victory in the national election, the home health industry started speculating that regulations could be pulled back. Investors seemed to take these speculations seriously, and some publicly-traded home health care companies saw their stock prices rally, along with the greater markets.

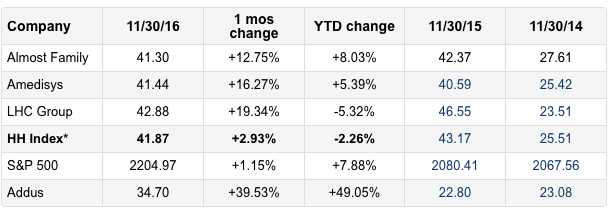

The Home Health Index by Stoneridge Partners rose 2.93% during November compared to the previous month. The index tracks the market values of Almost Family (Nasdaq: AFAM), Amedisys Inc. (NASDAQ: AMED) and LHC Group (Nasdaq: LHCG). After a few months of contractions, the index rebounded as all three companies saw gains in their stock prices during the month.

By comparison, the index rose just 0.79% in October, and the S&P 500 rose 1.15% in November. In a year of ups and downs, the overall index is down 2.26% year to date, compared to the 7.38% rise in the S&P 500.

“Home health stocks were rewarded in November in light of the results of the national election,” Rich Tinsley, president of Stoneridge Partners, said in a statement. “With an incoming Trump administration, the potential for home health regulations to scale back in 2017 may have markets rallying at the end of the year, with home health joining the rising tide.”

However, it wasn’t just the election that may have boosted stocks in the industry, as some experienced successful third quarter earnings in reports released during November.

LHC Group, based in Lafayette, Louisiana, saw its stock jump a whopping 19.34% in November from October. Investors may have been bullish on a joint venture with hospital provider LifePoint Health (Nasdaq: LPNT) that was announced in November. LHC Group will take over operations for 20 home health locations and 10 hospice locations owned by LifePoint. The company’s stock immediately rose following the announcement last month.

However, the market value for LHC Group, along with Amedisys and Almost Family, slumped during the prior month.

Almost Family also recently announced a major joint venture at the end of October, with Community Health Systems (NYSE: CYH), for $128 million. The deal creates the largest public hospital-home health joint venture in the nation. Just a few weeks after that announcement, the Louisville, Kentucky-based company reported record-setting earnings for third quarter of the year. For the month of November, Almost Family’s stock rallied 12.75% from October, according to the Home Health Index. Year-to-date, the stock is up 8.03%.

By contrast, Baton Rouge, Louisiana-based Amedisys reported mostly dismal earnings in the third quarter of the year. However, its stock still rose 16.27% during November, and is up 5.39% year to date.

Amedisys dealt with weather-related challenges and high expenses during the third quarter of the year, which weighed on its stock price, along with little growth in its home health division.

In addition, the company has undergone significant changes at the executive level, including naming a new chief operating officer, effective at the beginning of 2017. Amedisys also recently hired a new chief clinical officer. At the same time, its CIO departed the company, and its CFO announced plans to retire earlier this year.

While these c-suite changes seemed to spook investors for a time, the rally in Amedisys’ stock price November—and the overall increase in the Home Health Index—could signal home health stands to gain.

Written by Amy Baxter

Companies featured in this article:

Almost Family, Amedisys Inc., LHC Group Inc, Stoneridge Partners