Home health stocks climbed upward in November amid news that two of the industry’s biggest players are merging, according to the Home Health Index December update from M&A advisory firm Stoneridge Partners.

Louisville, Kentucky-based Almost Family, Inc. (Nasdaq: AFAM) and Lafayette, Louisiana-based LHC Group, Inc. (Nasdaq: LHCG), vowed to join forces on Nov. 16. The deal, set to close in 2018, will create the second-largest home health care provider in the nation and result in a company with a combined revenue of $1.8 billion. The implied transaction value is $2.4 billion, according to LHC Group.

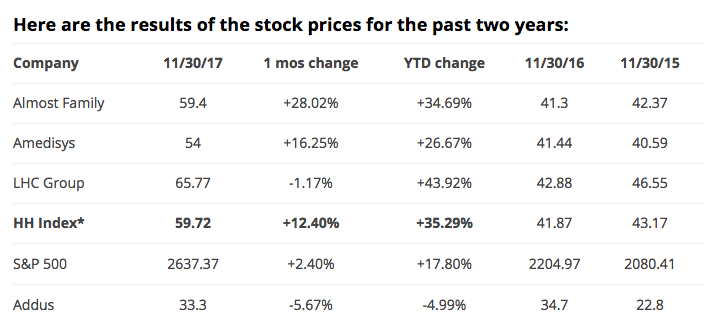

Investors seemingly saw the deal in a positive light. The market value of the three largest publicly traded home health companies rose 12.40% in November, according to the latest index. By comparison, the S&P 500 ticked up 2.4% in the same month.

LHC Group saw its stock value sink 1.17% in November, while its soon-to-be co-operator, Almost Family, added 28.02% to its share price that month. Meanwhile, the market value of Baton Rouge, Louisiana-based Amedisys (Nasdaq: AMED) rose 16.25%.

Addus HomeCare (Nasdaq: ADUS), which is not included in the index because so little of its income comes from Medicare, shed 5.67% from its stocks in November.

“When finalized, the merger between Almost Family and LHC Group will likely result in a big change for industry investors,” said Stoneridge President Rich Tinsley. “It will also change this Index, as we intend to add to it Kindred Healthcare.”

The combined organization will trade on the Nasdaq under the symbol “LHCG” and operate out of Lafayette, Louisiana. In total, it will have 781 locations in 36 states and over 31,000 employees.

Once the merger closes, LHC Group Chairman and CEO Keith Myers will serve as chairman and CEO of the combined company, while William Yarmuth, Almost Family’s current chairman and CEO, will stay on as a special advisor. LHC Group shareholders will own 58.5% of the combined company, while Almost Family shareholders will own 41.5%.

Executives from both companies teased the new company would be “better, faster, stronger” during a call analysts on the day the deal was announced.

“Both companies have been on pretty amazing trajectories,” said Steve Guenthner, president and principal financial officer at Almost Family. “This is continuing those trajectories. Think about Kanye West—[we’re going to be] bigger, better, faster, stronger.”

Written by Tim Regan

Companies featured in this article:

Addus HomeCare, Almost Family, Amedisys, LHC Group, Stoneridge Partners