Nearly half a year has gone by since the start of the COVID-19 public health emergency. During that time, home health organizations have faced volatile census swings, rising equipment costs, unpredictable staffing situations and a bevy of other challenges.

While not all operators have weathered the storm, most have. Now, as the home health landscape starts to stabilize, industry leaders are starting to look toward the future — and many like what they see.

That includes Encompass Health’s April Anthony, who leads the Birmingham, Alabama-based company’s home health and hospice segment.

“It may take a while before we get back to our old, normal, pre-COVID levels as a country,” Anthony told Home Health Care News during a recent video interview. “But I think home health care is in a position — and hospice as well — to really come out of this bigger, better and stronger than our industry has ever been in the past.”

With more than 320 combined locations, Encompass Health is the fourth-largest provider of Medicare-certified home health services and a top-11 provider of hospice services.

At the center of Anthony’s optimism is a growing recognition from payers, policymakers and peers of what can be safely be done in the home, both during emergencies and periods of calm.

“The world is responding to that and saying, ‘You know what? I want to be cared for at home,’” Anthony said. “I think we’re going to see a long-term trend of SNF diversions. I think we’re going to see patients looking to get as much care in their homes as possible, as opposed to an institutional setting. We’re going to be, in the long run, a benefactor of that.”

On the rebound

In part, Anthony’s positive outlook stems from how quickly her own organization has recovered from early coronavirus disruption.

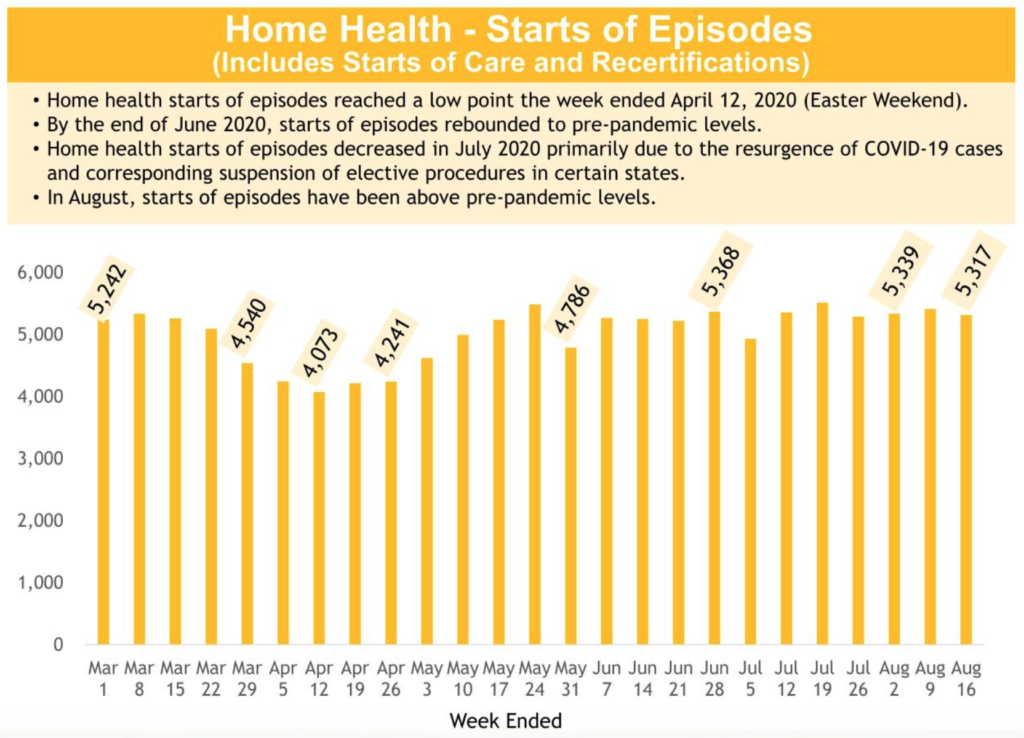

Going into March, Encompass Health’s home health operations recorded more than 5,240 total episode starts, which include new starts of care and recertifications. That figure held steady until the middle of the month — then plummeted.

For the week of April 12, Encompass Health’s home health operations saw less than 4,100 total episode starts. Volumes improved slightly, but remained comparatively down over the next couple of weeks — until shooting back up in May.

“Our story is a lot like the rest of the industry,” Anthony said during the HHCN video interview, which was sponsored by Homecare Homebase.

By the time Encompass Health hit the end of June, home health volumes were back to almost 100% of its pre-coronavirus levels. Today, the company’s volumes are actually higher than pre-coronavirus levels, with more than 5,300 total episode starts for the week of Aug. 16.

Encompass Health has seen that rebound across both its Medicare and non-Medicare populations, Anthony added.

“We tend to be heavily focused on the Medicare side of things and talk more about that, but we’ve actually seen a nice increase as well in our non-Medicare [average daily census] from a recovery perspective,” she said.

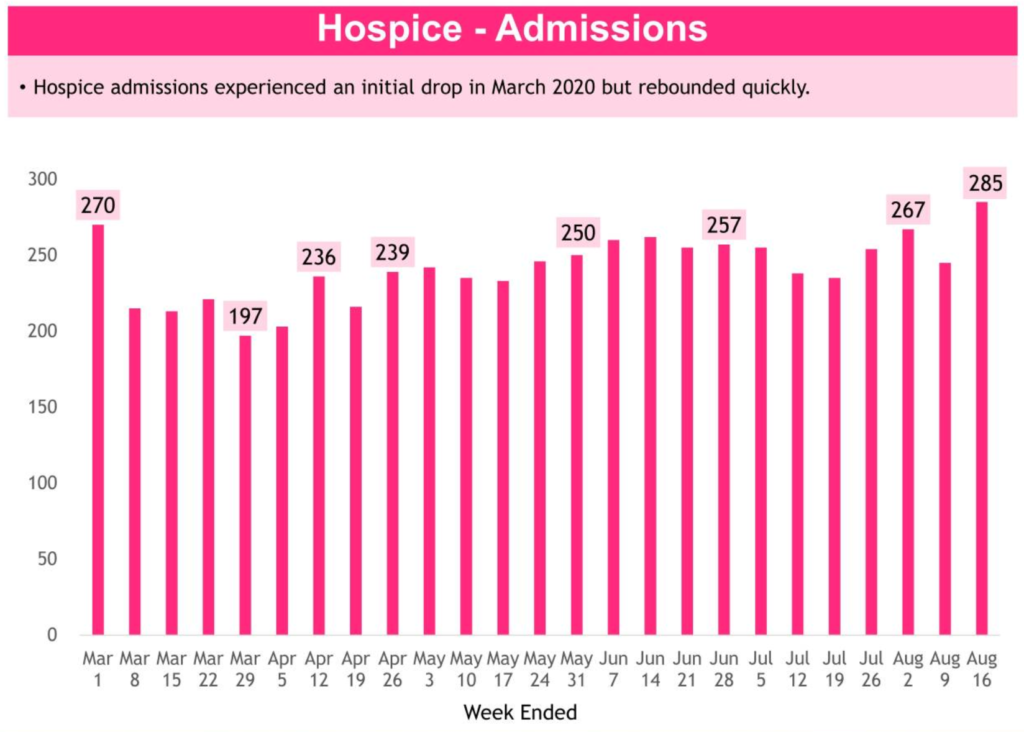

Encompass Health’s hospice volumes have been much more stable over the past several months.

Even with COVID-19 resurgences in some parts of the country, Encompass Health is unlikely to see the same kind of volume hit moving forward. Everyone from hospitals and health systems to physicians and patients are now more prepared for the virus, meaning there’s generally less panic and fewer knee-jerk reactions.

“If you look at what happened to just hospitals’ census during those first few weeks of the pandemic, … we weren’t just having the decline in elective procedures,” Anthony said. “As we well know now, people were seeing fewer heart attacks. We were seeing fewer strokes — just everything across the board was suppressed there for a time. People were scared to seek care, even when it was a very legitimately needed situation.”

Prioritizing staffing

Volumes have normalized for Encompass Health. Securing personal protective equipment (PPE) for clinicians and field staff has also become a lot easier — yet still costly — compared to the “dicey” early days of the public health emergency, according to Anthony.

“I was literally spending the better part of every day tracking down, searching for and negotiating for PPE,” she said. “There were some pretty crazy conversations that happened throughout that process, with sources who probably were not legitimate that we ultimately didn’t go with.”

At the moment, the major challenge for Encompass Health’s home health and hospice business revolves around staffing, a point that other providers have also echoed.

Throughout the home health world, providers are experiencing more early exits from clinicians just one or two years away from retirement. Encompass Health has certainly seen some of that, Anthony said, but it has likewise seen cases where younger individuals leave their positions due to non-work-related circumstances back home.

“We’ve seen mothers with young children — our nursing and therapy staff — sometimes say, ‘I’ve got to make a choice because my kids are home,’” she pointed out. “[They’re] trying to be a teacher, trying to be a parent, trying to do all these things.”

To support its field clinicians, Encompass Health instituted a two-week paid-days off (PDO) bonus, something the company did even when it was losing money due to the volume dips. The goal was to give workers flexibility if they needed time off to care for a loved one at home or to recharge after serving on the front lines, caring for COVID-19 patients in the home.

“That was a $15 million expense that we were taking on during the midst of a very low census period,” Anthony said. “So, it was kind of a double-whammy to the bottom line in the near term, but very much the right thing to do for our people.”

Meanwhile, to recruit new workers, Encompass Health has also launched a special talent-acquisition program to fill open positions.

“I would certainly agree that, at this moment, staffing is our No. 1 challenge and our No. 1 priority,” Anthony said.

Despite the operating difficulties caused by the COVID-19 virus, Encompass Health has not had to lay off or furlough any workers. The company did, however, make a change related to the compensation structure of some full-time workers.

Specifically, Encompass Health noticed how therapy visits had drastically decreased, partly because long-term care facilities were shutting their doors to everything other than essential services. To account for the severe drop in therapy, the company lowered pay for its full-time therapy staff by 20%, simultaneously lowering their productivity standard by 20% as well.

Still — if the work was available in their markets — therapists could keep working at that full, normal productivity standard, keeping their pay the same. Anthony described the payment plan as a “shared-risk shift.”

“We took the entire therapy discipline pool and cut the salaries by 20%,” Anthony said. “We brought them down from a 100% plan to an 80% plan. But with that, we also cut their productivity standard by 20% — and gave them the opportunity to earn over-productivity.”

‘A real quandary’

The future of home health care may be bright, but there’s still work that needs to be done around the Patient-Driven Groupings Model (PDGM) and the behavioral assumptions from the Centers for Medicare & Medicaid Services (CMS), which are increasingly being proven inaccurate.

While Encompass Health is gearing up for next year, planning for 2021 and beyond is complicated by the coronavirus disruption, Anthony said.

“I’m an accountant by nature, so I love metrics and data and baselines,” she said. “You’re talking my language when you bring those things up. But it has been a real quandary to try to figure out, ‘Okay, what is the baseline? And what’s being affected by COVID and what’s not?’”

In terms of M&A, smaller deals have dried up completely. Many home health agencies in the $5 million to $10 million range have taken advantage of Provider Relief Fund grants, CMS loans and the Paycheck Protection Program (PPP), effectively delaying PDGM-induced consolidation.

Anthony expects those deals to pick back up toward the end of 2020. Larger deals may return sooner.

“I think there will be some larger transactions that have weathered the storm well and that will still be very viable acquisition candidates,” she said. “Players that are well-capitalized will have the opportunity to buy some of those bigger transactions here in the back half of the year.”