Following the Centers for Medicare & Medicaid Services’ (CMS) release of the final payment rule, it is critical for each home health agency to figure out its own financial standing and strategic plan for 2023.

In addition, agencies should be finding key areas for improvement and educating clinicians on the recalibrated case-mix weights and Low-Utilization Payment Adjustment (LUPA) thresholds.

Those suggestions came during a Thursday webinar with experts with the home health consulting firm SimiTree.

“Each agency is going to be different in terms of what the financial impacts are going to be,” Nick Seabrook, managing principal at SimiTree, said. “The LUPA threshold going down is going to be a pretty significant change to agencies and that could move the needle pretty significantly from a revenue standpoint as well. It’s important to know what the impact of this is for your agency.”

The final rule comes with an estimated increase to 2023 home health payments of 0.7%, or $125 million, compared to 2022 aggregate payments.

Despite the initial reprieve, CMS is still phasing in other cuts and permanent adjustments related to the rebalancing of the Patient-Driven Groupings Model (PDGM).

CMS also determined that when the Home Health Value-Based Purchasing (HHVBP) Model goes nationwide, the baseline year for home health agencies will be 2022.

That creates some murkiness as it relates to how agencies can evaluate their own businesses.

“We’re going to be in the dark to start 2023 for [HHVBP],” Seabrook said. “Look at some of those trends now for VBP measures, so you really can determine what your strategic plan will be next year. If there are two or three key areas you really want to focus on for improvements, that really should be what you look to do between now and the end of the year.”

Seabrook and John Rabbia — the director of SimiTree — also walked agency leaders through some of the methodologies CMS used to determine the final rule.

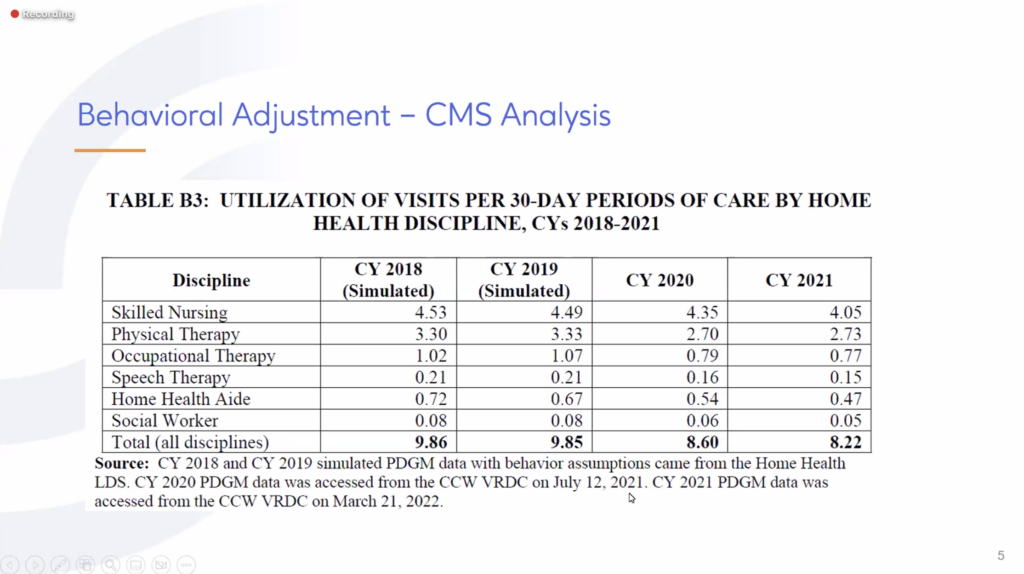

One of the ways CMS came up with the rule was it figured that at pre-PDGM levels, utilization for home health visits was about 10 visits per 30-day period. In 2020, that number was 8.6, or about a 14% reduction in visits.

The main disciplines that were impacted were physical and occupational therapy. That number continued to fall in 2021, which can be attributed to the therapy and nursing shortages the industry is facing, Seabrook said.

“This is really the crux of how CMS came up with the fact that we have a behavioral adjustment,” Seabrook said. “[CMS is] not taking into consideration the fact that 2020, we know, was Year 1 of the pandemic. We were dealing with patients being sick and not being able to be seen, dealing with clinicians being sick and not being able to make visits, and that really compounded into 2021 as well. This was really the basis for how Medicare came to the conclusion that they’re overpaying at this point.”

PDGM changes

It’s important for agencies to understand what the recalibration for PDGM means going forward.

“What CMS did — right, wrong or indifferent — is they took 2021 utilization data and they adjusted the various case-mix weights for all the [groupings] to bring those closer in line and make it a budget-neutral approach,” Rabbia said. “They applied the proposed 2023 case-mix to 2021 claims data in order to model all of that out and simulate what it would look like to try to get to a neutral payment, as if we were looking at the 2022 case-mix weights.”

That resulted in a budget neutrality factor of 0.9904.

What agencies should take from this, Rabbia said, is to pay close attention to their utilization per period and to make sure it is in line with expectations, so it matches up with what their payments will be.

It was also noted that the final rule will not have different effects based on the size of agencies when it comes to the LUPA threshold. Geography, however, will see some variation.

“Urban agencies are expected to be impacted a little bit more than rural agencies,” Rabbia said.

“Urban agencies will see about a 4.3% decrease as opposed to rural agencies with a 3.4% decrease,” he continued. “We don’t really see, in the modeling, any significant impact based on agency size. Small, medium or large, it isn’t really going to have a huge impact. It’s mainly geography and urban versus rural.”

There is good and bad tied up in CMS’ final rule. There is work to be done on the agency and advocacy side of things, Seabrook said, while making a topical analogy for sports fans.

“The situation we’re in now is like if you had bases loaded and no one out and you’re the pitching team,” Seabrook said. “Then the batter grounded into a double play. A run scored, but you got two outs out of it. That’s kind of how I equate the final rule summary.”