As the value of home care services has become increasingly more apparent within the health care sector, it should come as no surprise that dealmaking in the space began to heat up last year.

Despite this previous rise in M&A activity, a number of economic and sector-specific factors have opened the door to headwinds that have slowed down the acceleration taking place in the market, according to The Braff Group President Dexter Braff.

“Last year was a record-breaking year for transaction volume and private-duty across the board, when you add both Medicaid and private pay,” he said last week, during a presentation at Home Health Care News’ Home Care Conference. “The unfortunate thing is this year, it’s way down.”

In 2021, the total number of transactions completed for health care services companies was almost a third — 30% — higher than the previous record, based on The Braff Group’s numbers since 2001.

Overall, there were more than 50 home care transactions in 2021.

Taking a step back, and examining 2021, there were a number of contributing factors that led to the record-breaking dealmaking.

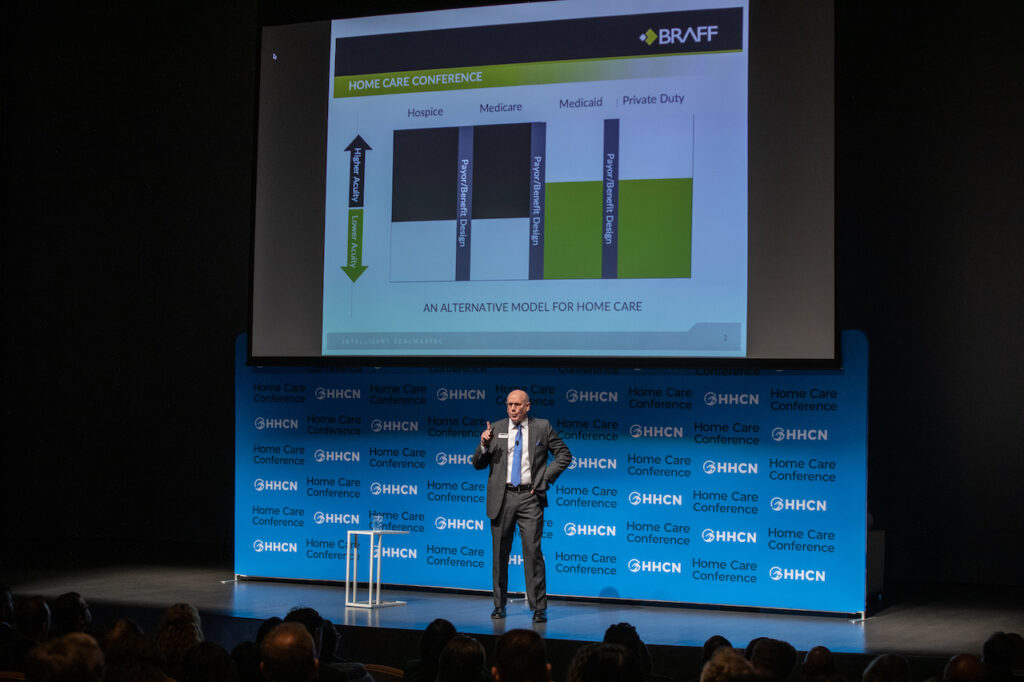

The first factor was the emergence of alternative payment systems, according to Braff.

“Quite frankly, when health care reform was passed in 2009, it was probably best known for guaranteed issue,” he said. “It was known for Medicaid expansion. It was known for a lot of controversy … but tucked away in health care reform was the development of CMMI, The Center for Medicare & Medicaid Innovation. That will actually go down as the single most significant thing that happened out of the Affordable Care Act.”

After being established, CMMI immediately began work on alternative payment models, and started experimenting with global payment systems and pushing it out into government payment.

This meant capitated agreements, episodic or bundled payments, population health and more.

“They started with ACOs,” Braff said. “They did bundling with hip surgery, they developed all different kinds of models, where rather than a fee-for-service, they were going to be paying people based on treatment of a condition, treatment of a population, treatment of some sort of a global payment system.”

This ushered in a new wave of players who would enter the market looking to “consolidate continuums of care,” making care transitions more smooth and cost effective, while also improving health outcomes.

Another factor that contributed to the home care dealmaking spike in 2021 was that there were expectations of increased capital gains.

“There was a concern that capital gains rates were going to rise, effective 2022,” Braff said. “Therefore, a lot of people wanted to get deals done in 2021. That accelerated deal flow, capital gains didn’t rise, so that didn’t become an issue.”

Cheap debt also contributed to the rise. Plus, the staffing shortages seen across home-based care were a factor driving up transactions. Prior to the pandemic, the gap between job openings and new hires was 500,000 or more.

This rose to over 1 million, and currently stands at roughly 1.2 million.

“The reality of it is, in many cases, if you want to grow, you have to buy, because it’s hard to expand without having the right people available for you to fill those positions,” Braff said.

Flash forward to 2022

In 2022, the volume of transactions is only slightly — 5% — down, but when taking a closer look, it’s clear that the average amount of investment has decreased.

“It’s gone down for a lot of the reasons that you might anticipate — concern about the economy, inflation, debt going up in terms of cost,” Braff said. “It’s not unusual, during the period of economic uncertainty, for buyers to continue to buy, but lowering the amount of investment per transaction. That way, they can spread out their money a little bit further, diversify their risk, and continue to be in the game without making big bets.”

Currently, buyers are moving their focus from home care to Medicare-certified home health care.

This is because home health care is finally moving past the uncertainty that the Patient-Driven Groupings Model (PDGM) created in that space.

“Reimbursement was kind of unclear in 2020 and 2021,” Braff said. “It’s now very clear, and so buyers aren’t as nervous as where they were. They’re now rushing back into the Medicare space, which takes interest away from other segments of the business.”

Plus, there aren’t as many big players in home care when compared to its home-based care counterparts.

In fact, the majority of home care players have revenues below $5 million.

“Those become a little bit less from an acquisition target standpoint, because you have to buy a lot in order to gain some market share,” Braff said.

Looking ahead, Braff pointed out that the fundamental drivers remain the same.

“Even though the numbers are down, if you want to add a reasonably sized private-duty agency or Medicaid company and came to me saying, ‘Your numbers really showed that there’s not a lot of activity, do you think that we could get a good price?,’” he said. “My answer would be absolutely. I just think there’s less activity, but there are buyers out there. There may be fewer, but they’re out there because of all the things we said about the idea of moving things into the home.”

However, the interest rate environment is also rocky. Increasing interest rates will make debt more expensive. Additionally, high inflation and the slowing economy will likely scare some buyers away.

Still, while the market is unlikely to see a repeat of 2021, in general, home-based care has a strong appeal.

“Overall, the trend continues, … because of global payment systems, capitated agreements, and the like, puts this group and its Medicare, Medicaid and hospice peers in the driver’s seat as the solution to keeping costs down,” Braff said.