Amedisys Inc. (Nasdaq: AMED) and Option Care Health (Nasdaq: OPCH) announced Wednesday that the pair have entered into a definitive agreement to combine.

Amedisys is one of the largest independent providers of home health services in the country, along with several other home-focused services. Option Care Health, meanwhile, is one of the largest providers of home and alternate site infusion services.

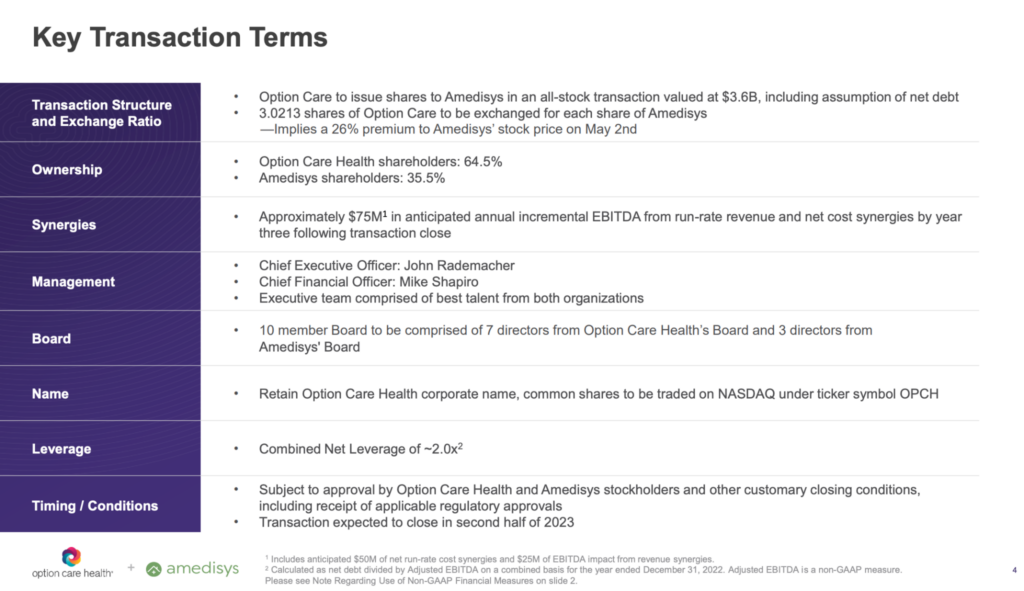

The deal values Amedisys at $3.6 billion. That number is a 26% premium compared to Amedisys’ closing stock price on May 2.

“This transaction reflects the strength of our business and the great potential of care delivery in the home,” Amedisys President and CEO Richard Ashworth said on a joint call Wednesday evening. “The bottom line is we see tremendous upside from joining with Option Care Health for our patients, their families, providers, payers, care teams and our stockholders.”

Ashworth took over for long-time Amedisys CEO Paul Kusserow in April. A month later, the company is hitching its horse to Option Care Health, which will become one of the biggest comprehensive providers of home-based care in the country upon the deal’s closing.

Scott Ginn, the acting COO and CFO at Amedisys, will remain a part of the combined company’s leadership team, as will Chief Strategy Officer Nick Muscato. Ashworth, on the other hand, is already moving into a “special advisor role,” and he will report to Option Care Health President and CEO John C. Rademacher.

The deal is expected to close in the second half of 2023, according to the companies. Combined, Amedisys and Option Care Health generated revenues of $6.2 billion for full-year 2022.

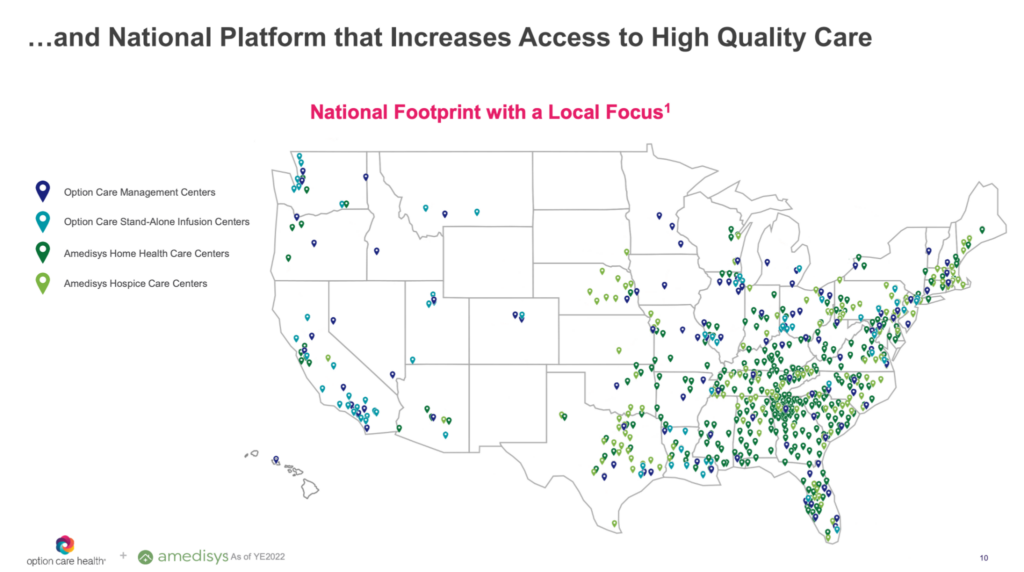

The Baton Rouge, Louisiana-based Amedisys provides home health, hospice and palliative care services, as well as other forms of higher-acuity home-based care. Overall, its network includes 16,500 employees and 522 care centers across 37 states and the District of Columbia.

On its end, the Bannockburn, Illinois-based Option Care Health provides infusion services via its 7,500 employees and 4,500 clinicians across all 50 states.

“This is an exciting combination and one which positions us to create a leading independent platform for home and alternate site care,” Rademacher said on the call. “Through this transaction, we are bringing together Amedisys’ home health, hospice, palliative and high-acuity care services, with the Option Care Health complementary home and alternate site infusion services.”

As part of the deal, Amedisys stockholders will receive 3.0213 shares of Option Care Health stock for each share of Amedisys common stock they hold.

Upon closing, Option Care Health stockholders will own approximately 64.5% of the combined company, and Amedisys stockholders will own approximately 35.5%.

“Today, we are seeing not only aging populations and growing desire for at-home health care services, but also increasing therapeutic pathways,” Rademacher continued. “Importantly, by expanding beyond our existing services, we’ll be able to better meet increasing demand for alternative-site care, and we believe the combined company’s capabilities and scale will position us to capture a significant share of the market.”

In the first quarter, Amedisys’ net service revenue totaled $556.4 million, a 2% year-over-year increase. The home health segment accounted for $343.3 million of that, marking a 2.2% year-over-year increase. While traditional Medicare revenue declined, non-Medicare revenue was up.

Total home health admissions for the quarter hit 101,963, an 11.1% year-over-year increase.

How, and why, the deal came together

Amedisys and Option Care Health have been partners for over two years now. The relationship began at the height of the COVID-19 pandemic when the two companies worked together on bringing infusion therapy to vulnerable populations.

More recently, Option Care Health and Amedisys’ high-acuity care subsidiary, Contessa Health, have been working together.

“The reality is that we’ve had a tremendous, collaborative relationship with Amedisys dating back to Operation Warp Speed, when we were trying to deliver monoclonal antibodies,” Option Care Health CFO Mike Shapiro said on the call. “That evolved, and over the last six months, we’ve deepened our relationship with the Contessa platform to help coordinate care as well.”

Despite Contessa Health’s initial financial drag on Amedisys’ finances, the latter’s $250 million acquisition of the former seems to have paid off in the long run.

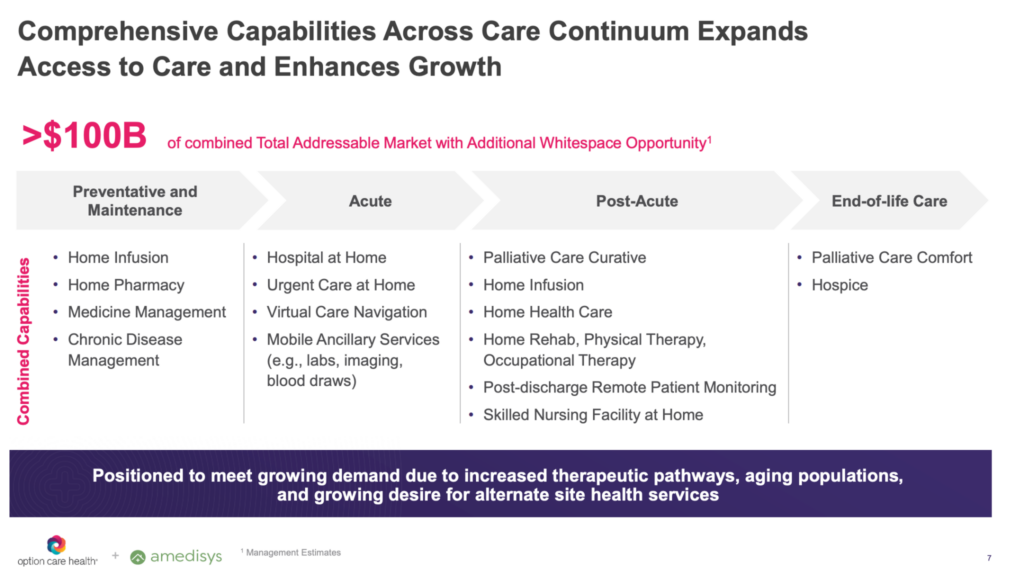

Now, together, the companies see far more opportunity ahead. Creating that “end-to-end” continuum of care, they believe, will help the company address a combined $100 billion total addressable market with “additional whitespace opportunity.”

“Relationships with providers and health systems are paramount to enabling patient care,” Rademacher said. “Health system referral networks are increasingly looking for a single provider partner for home health, infusion and hospice pathways and transitions. … Together, we will bolster our offerings to meet the increasing demand for personalized care in the home or alternative sites and will move deeper into value-based care.”

Developing that single-stop shop for health systems is major part of the ethos behind the merger. Option Care Health, with Amedisys under its belt, with be able to offer the vast majority of needed care for patients in their homes.

Value-based care is another piece of the equation. And the wide range of service offerings will help there, too.

But the payer mix of the combined company will also be far more diverse than either company’s mixes today. For instance, 88% of Option Care Health’s payer mix is currently commercial. Amedisys, on the other hand, has a payer portfolio driven by government pay, which accounts for 76% of its pie.

After the transaction is finalized, the commercial and government pay mix will balance out.

“Notably, the transaction is expected to result in a more diversified revenue base through improving the company’s access to private payers and government managed health plans,” Rademacher said. “[Paired with Amedisys in 2022], 65% of our revenue base was with commercial payers, and 35% with government payers.”