This article is a part of your HHCN+ Membership

While some of the other subsectors already have more clarity on what their CY2024 may look like, home health operators are still operating in the dark. The home health proposed payment rule is still likely a month away, and the final rule likely more than four months out.

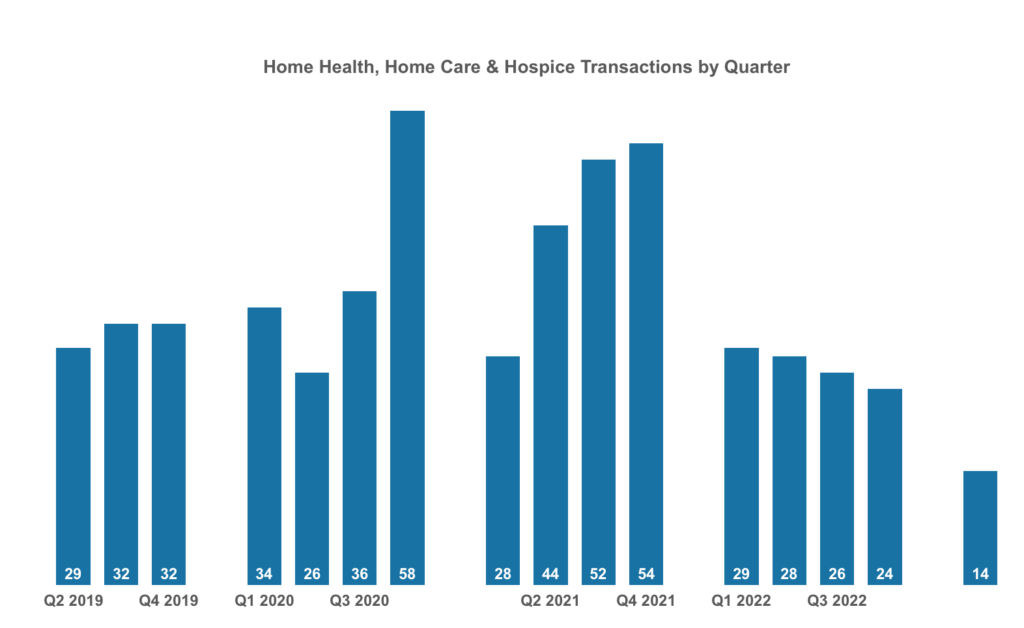

It seems most are expecting the worse – yet another payment rate cut from the Centers for Medicare & Medicaid Services (CMS). That lack of clarity – paired with pessimism – likely led to one of the lowest transaction quarters for home-based care in recent history in Q1.

And yet, one of the largest home health deals ever was just announced, with the news that Option Care Health (Nasdaq: OPCH) and Amedisys Inc. (Nasdaq: AMED) are set to combine.

There’s a lack of clarity on future payment rates. Transactions are down. And yet, it didn’t come as a shock to experts that Amedisys was joining forces with a larger partner.

“I don’t think there was was much surprise at all to see Amedisys announce that they are partnering and merging with another company,” Scott Fidel, managing director at the private investment banking company Stephens, told Home Health Care News. “There has been a lot of focus and speculation around whether Amedisys and other large standalone home health and hospice operators would be looking to merge given recent trends.”

For the last couple of years, some industry insiders have believed M&A has tapered off – especially in Medicare-certified home health care – due to too high of asking prices from sellers. From the buyer perspective, those asking prices have been viewed as too high for primarily two reasons: micro economic factors such as inflation – and higher interest rates – as well as micro factors, such as the rate cuts and potential clawbacks from CMS.

“While we continue to believe strongly in our strategy of pairing home health care with personal care, we believe it is prudent to focus on modifying this proposed rule prior to our continuing development efforts in the personal care market,” Addus Homecare Corporation (Nasdaq: ADUS) CEO Dirk Allison said on the company’s first-quarter earnings call.

Allison also added that there should be more – and “larger” – home health opportunities in the future, but that there is a need for “seller expectations to be rationalized.”

Option Care Health didn’t wait for the finality of a payment rule, however. That came as a surprise to some, but so did the deal – from the Option Care Health side – in the first place.

“From the Option Care shareholder perspective, this was a significant surprise for their investors,” Fidel said. “I do think many Amedisys shareholders were anticipating that there would be some type of combination, even if Option Care Health as the other company ultimately came as a surprise.”

Ultimately, large and small deals will continually be made during 2023, even after a historically low transaction total for Q1. The buyer side, however, is what is likely to change.

In 2023, the strategics committed to building out clinical strengths will likely account for the most M&A activity. On the other end, PE buyers that have specific, monetary ROI needs will likely remain quieter.

PEs, payers and strategics

The PE rush to home-based care has been waning for some time now. The aforementioned interest rates and payment rates – as well as compliance issues – have made sure of that.

“In line with our predictions, PE healthcare services investment declined for the fifth straight quarter to 200 deals in Q1 2023 – 21.5% off the pace set in 2021 but still 20.4% higher than the average quarter in 2018-2019,” a recent Pitchbook report read. “The industry is settling into a new normal of higher interest rates, lower multiples, and slower, more proprietary deal processes.”

Meanwhile, payers – also big-time buyers of home health care of late – may also not be a source of M&A for home health care providers moving forward. Not all of them want to be a Humana Inc. (NYSE: HUM) or a UnitedHealth Group (NYSE: UNH), which have been building out provider capabilities.

“A number of the other major ones out there have a bit of a different strategy as it relates to acquiring direct clinical assets,” Fidel said. “If you at Cigna, Elevance, Centene, or Molina now, they are not pursuing the build out of direct clinical platforms in the same way that United, Humana and CVS are.”

There was some feeling that all payers would begin rushing to home health care sellers to build out their own version of the Humana, CVS Health (NYSE: CVS) and UnitedHealth Group blueprint, but that hasn’t been the case.

And if PE firm and payer activity is tapering in M&A, that leaves the strategics.

The ones directly impacted by the same challenges as home health sellers – such as Addus – may wait for the proposed or final rules until they ramp up M&A again.

But they will still find value in buying assets, whether that’s to acquire more value-based care capabilities, more scale or more workers. The same goes for Option Care Health, even though it is a part of another health care service subsector entirely.

While PE firms are looking to buy, sharpen, build and sell, Option Care Health sees the long-term value of having home health and hospice capabilities in its portfolio.

“This is a complimentary transaction, it will expand access through the creation of broad capabilities across the care continuum,” Option Care Health President and CEO John C. Rademacher said earlier this month. “Amedisys brings a strong presence in hospital at home, home health, hospice, palliative and high-acuity care services. This fits directly with Option Care Health’s existing home and alternate site infusion services, allowing us to bolster our offerings and meet the growing demand for personalized care in the home and alternate sites.”

Option Care Health’s decision to expand its continuum to create more value to payers, and, in turn, more money for itself, is still sensical.

For everyone else, macro and micro trends will need to change. But for strategics, there’s still reason to add on to scale and capabilities.

Companies featured in this article:

Addus HomeCare Corporation, Amedisys Inc., Mertz Taggart, Option Care Health, Pitchbook