Margins for Medicare-certified home health agencies are projected to remain strong in 2021, despite ongoing challenges tied to the COVID-19 pandemic and the shift to the Patient-Driven Groupings Model (PDGM).

Margins are anticipated to be so robust, in fact, that Congress should reduce the 2021 Medicare base payment rate for home health agencies by 5% going into next year. That’s according to the Medicare Payment Advisory Commission (MedPAC), which released its March report to Congress late Monday.

“Home health care can be a high-value benefit when it is appropriately and efficiently delivered,” MedPAC commissioners wrote in their report. “Medicare beneficiaries often prefer to receive care at home instead of in institutional settings, and home health care can be provided at lower costs than institutional care. However, Medicare’s payments for home health services are too high, and these overpayments diminish the service’s value as a substitute for more costly services.”

Established by the Balanced Budget Act of 1997, MedPAC is an independent agency formed to advise Congress on issues affecting the Medicare program. It has no lawmaking or regulatory power itself, but the federal government frequently uses the body’s reports as guides during the decision-making process.

MedPAC’s March report is mostly based on 2019 numbers due to standard data lags. Its forward-looking projections do supposedly take into account the 2020 implementation of PDGM and the public health emergency (PHE).

“Though the PHE was a disruption for [home health agencies], the emergency has not significantly changed the financial outlook or service delivery practices of the industry,” the MedPAC report states.

About 3.3 million Medicare fee-for-service beneficiaries received care from a home health provider in 2019, with Medicare spending $17.8 billion on those services. Over 11,300 agencies participated in Medicare that year.

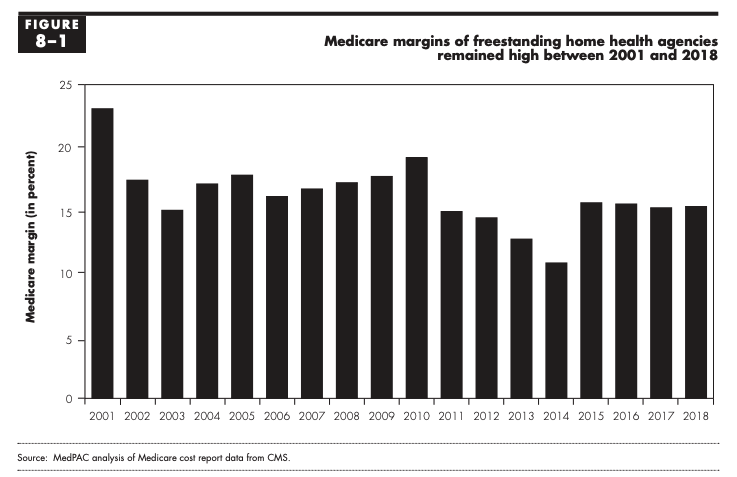

As far as past financial figures, the aggregate fee-for-service (FFS) Medicare margin for freestanding home health agencies was 15.8% in 2019, according to MedPAC. Margins ranged from as low as 3% to 24.5%.

Generally, for-profit home health agencies had higher margins than nonprofit providers, with urban agencies typically having higher margins than their rural peers. Additionally, agencies with higher volume levels often had better financial results, likely reflecting the economies of scale possible for larger operations.

For example, margins for agencies in the bottom quintile of episode volume averaged 9.8%, compared with a 17.4% average margin for organizations in the top quintile, MedPAC noted.

In the past, home health insiders have warned that MedPAC’s views on margins are largely inflated, partly because the commission doesn’t factor Medicare Advantage (MA) into the equation.

“[Agencies] have reported that MA payment rates are lower than FFS, but that they accept the lower rates because they need managed care patients to remain competitive or economically viable,” MedPAC’s commissioners explained in the March report. “Some noted the need to accept managed care patients in markets where managed care beneficiaries are a significant share of the Medicare population.”

For 2021, MedPAC projects industry-wide Medicare margins of 14%. Its estimates are an extrapolation based on prior experience and anecdotal industry reporting, since complete cost and utilization data for 2020 are not yet available.

MedPAC has called for cuts to home health spending for years, so recommendations in the March report aren’t overly surprising.

Although the commission is firmly behind its stance of cutting home health payments by 5% next year, it also recognizes some of the hardships providers faced during the pandemic.

“COVID-19 has required [agencies] to use more personal protective equipment, and there have been reports that this equipment has increased in price and sometimes has been hard to procure,” the commissioners wrote. “[They] have also reported lower payments because beneficiaries were initially declining home health visits. While home health care volume returned to normal levels later in 2020, there remains uncertainty regarding the future effects of the pandemic on volume and provider financial performance in 2021 and 2022.”

Number of home health agencies continues to decline

While margins remain up, the number of Medicare-certified home health agencies in the U.S. continues to decline, according to MedPAC.

Between 2018 and 2019, the number of agencies declined by 1.7%, continuing a steady decline that started around 2013. The 2019 decline was concentrated in Florida and Texas, states with a history of program integrity concerns frequently hit with anti-fraud measures, including criminal investigations and new-agency moratoriums.

The supply of home health agencies varied greatly among states in 2019, with Texas averaging 7.9 agencies per 10,000 FFS beneficiaries and New Jersey averaging less than one per 10,000 beneficiaries.

Despite the decrease in the number of agencies, access to services remains healthy.

Over 99% of Medicare beneficiaries lived in a ZIP code where at least one Medicare home health agency operated in 2019, according to MedPAC. Exactly 86% lived in a ZIP code with five or more agencies.