Amedisys Inc. (Nasdaq: AMED) continues to make significant process in its high-acuity care business through its subsidiary Contessa Health.

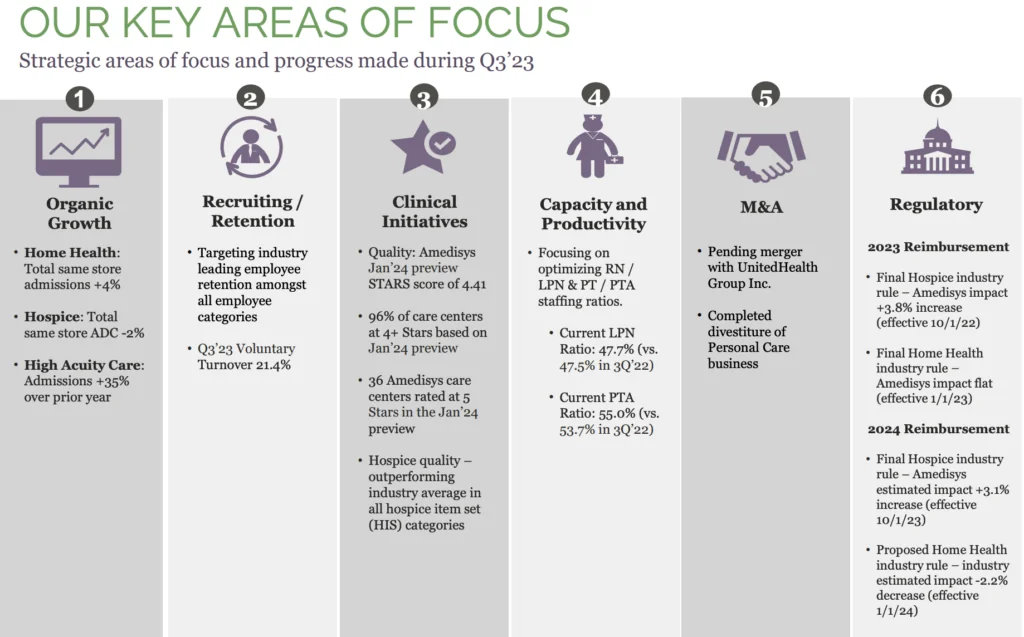

The company posted its third-quarter earnings late Tuesday, which highlighted 35% year-over-year growth in the high-acuity care segment. Overall, Amedisys admitted 580 high-acuity patients in the quarter in 11 JV markets.

The high-acuity care segment, as expected, has been a near-term drag on Amedisys’ financials. It lost $9.4 million last year in the third quarter, compared to just $7.4 million this year.

Overall, Amedisys net service revenue totaled over $556 million, a less than 1% decrease from the near $558 million it totaled during the same period last year.

Its home health segment totaled $351.6 million, a 3.7% year-over-year increase. Hospice net service revenue, on the other hand, increased slightly to $188.9 million.

Of note, while Medicare revenue decreased year over year in the home health segment, non-Medicare revenue increased significantly – from $113.6 million to 133.7 million, a 17.7% year-over-year increase.

Amedisys

AmedisysSame store home health admissions were also up 4% year over year, while total volume was up 3%. Revenue per episode increase by 0.8% to $3,015, but the visiting clinician cost per visit increased by 4.7% to $104.23.

Amedisys released its earnings without an accompanying earnings call due to UnitedHealth Group’s (NYSE: UNH) pending acquisition of the company. Both parties – UnitedHealth Group’s Optum and Amedisys – are still hoping to close on that acquisition in early 2024.