This article is a part of your HHCN+ Membership

According to the most recent data, an estimated 5.8 million people utilize home- and community-based long-term services and supports (LTSS).

Medicaid is the primary payer for LTSS. The U.S. spent over $400 billion on LTSS in 2020, nearly 10% of all health care expenditures. More than half of that spending went toward home- and community-based services (HCBS).

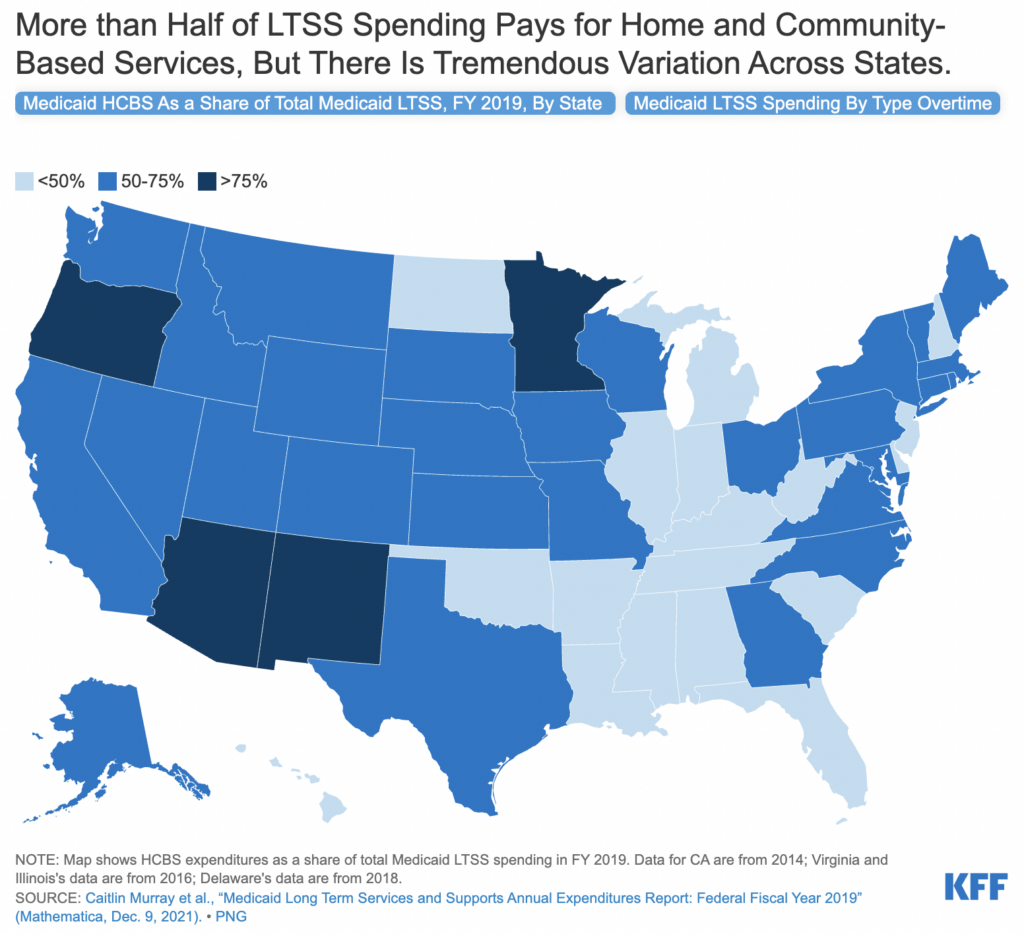

However, a recent KFF report found substantial state-by-state variation in the share of Medicaid LTSS expenditures that are spent on HCBS.

That gap ranges from 33% in Mississippi to 83% in Oregon. The reason for that discrepancy is multifaceted.

“Financial eligibility requirements for (LTSS) through Medicaid differs across states,” Mollie Gurian, vice president of home-based and HCBS policy at LeadingAge, told Home Health Care News. “Some have high asset thresholds for eligibility, while others are very low. Some use fixed income thresholds, while others use variable thresholds based on federally adjusted standards like the federal poverty limit.”

Of the many reasons why that spending differs from state to state is because the Medicaid HCBS benefit is optional.

“Nursing facility services are required under Medicaid for states to provide,” Alice Burns, associate director for the program on Medicaid and the uninsured at KFF, told HHCN. “Most long-term care that’s provided in the community is a state option. So when we think about why there is a difference across the states, the number one reason is that HCBS is an optional benefit and so states have much more flexibility in what they choose to cover. The number one thing contributing to the percent of spending that goes to LTSS is how many HCBS states are choosing to offer and to whom they’re offering them.”

LTSS refers to the broad range of paid and unpaid medical and personal care services that assist with activities of daily living (ADL).

Today, all 50 states and Washington D.C. provide HCBS to eligible adults 65 and older — and certain other populations — through a combination of state plan benefits and waivers. However, the specifics of those waivers and benefits — what those services are, who is eligible, how they are eligible, how many people are served, etc. — vary greatly from state to state.

What also varies by state is what specific HCBS services are covered under a state’s Medicaid waiver. Federal Medicaid statutes require states to cover institutional LTSS and home health care, but the rest of HCBS are optional.

“Some home health is also provided under Medicare, some home health is provided under private health insurance, some home health is HCBS,” Burns said. “That is the HCBS that all states provide. What is provided under Medicaid HCBS, though, goes way beyond personal care in many cases. This is where benefits start to become really specific to different populations.”

Those services may include wide-ranging personal need assistance to people with developmental disabilities or 24/7 care for those with traumatic injuries, for instance.

Those services, and the complexity of each of those patients, contributes to state-by-state spending variance.

“If we think about these different types of people, states have a lot of choices,” Burns said. “Do we offer a waiver to cover each of these different groups? If we do offer a waiver, what benefits are available and how many benefits? If a state provides around-the-clock care, the per-person costs of that are very likely to exceed the costs of having them in an institution. That doesn’t mean it’s not better. It just means that the state is going to be spending a whole lot more on HCBS if they’re covering people who need this 24/7 care in the community.”

HCBS expansion

Even though there is no mandate to cover all HCBS, Medicaid LTSS spending has shifted from institutional to non-institutional settings over the last several years as more people prefer care in the home.

Instead of mandates, the federal government has offered incentives through enhanced Federal Medical Assistance Participation (FMAP), where states who expand their HCBS activities can earn a boost in federal assistance.

“For example, the federal government may only pay a dollar for each dollar the state puts towards its HCBS program, but Congress could enact an FMAP bump for expansion of services,” Gurian said. “This most recently occurred in the American Rescue Plan Act, which offered a temporary 10% FMAP boost for all HCBS services. In this instance, instead of one-to-one, the federal government would pay 60% of the bill instead of half.”

That FMAP bump proved significant, especially for states expanding HCBS services.

Some states are actively expanding their HCBS capabilities. It’s worth noting, though, that many are still in the early stages of the process.

“One factor is the length of time that the state has had a home- and community-based service program in place,” Darby Anderson, chief strategy officer for Addus Homecare Corporation (Nasdaq: ADUS), told HHCN. “You look at some of the states near the top of the list, they were some of the first states in the country to have Medicaid waivers and have programs that provided ADL support in the home versus institution. Those states have had a longer period of time to increase the overall client enrollment and client census than some of the states that are near the bottom of that list.”

The Frisco, Texas-based Addus provides home-based care services to approximately 47,500 consumers through 203 locations across 22 states.

Since the public health emergency, states have used additional FMAP funds in a number of ways, like increased caregiver pay, expanding existing HCBS programs and investing in new services like Program of All-Inclusive Care for the Elderly (PACE).

LeadingAge, Gurian said, has been advocating for continuing this additional match permanently so that states can make ongoing investments in their HCBS programs.

“For example, providers might be able to permanently increase worker pay rather than offering one-time bonuses,” she said.