This article is a part of your HHCN+ Membership

UnitedHealth Group’s (NYSE: UNH) Optum snatched Amedisys Inc. (Nasdaq: AMED) away from Option Care Health (Nasdaq: OPCH) at the end of June.

If the $3.3 billion acquisition is finalized, Optum will own about 10% of the home health care market.

It would represent a seismic shift for a traditionally mom-and-pop industry. It would represent consolidation, but not in the way industry experts previously expected.

But what’s next for the two companies that dueled it out for Amedisys – and for Amedisys itself under Optum? In this week’s exclusive, members-only HHCN+ Update, I address these key questions:

– Optum owns a tenth of the market, but what does that mean for UnitedHealth Group?

– What’s next for Option Care Health? Its leaders were enthused at the idea of creating an at-home, end-to-end continuum. Is that still the vision?

– If it is, what company might be its next target?

Optum’s home health aspirations

If all goes well, Optum will technically become the largest provider of home health services. But even then, it will be lacking coverage in certain parts of the U.S. – particularly in rural areas where home health services are often considered valuable, but not accessible.

Once the LHC Group deal was finalized, UnitedHealth Group was already looking for ways to further expand its home health network. It made inquiries to other home health providers, not about potential acquisitions, but about becoming a part of a larger home health network.

Amedisys happened to come up for sale not long after the LHC Group deal was finalized in February. It was a reasonable price for another provider of LHC Group’s ilk, so Optum stepped in and put forth a superior, all-cash offer. That was one quick way to nearly double its home health footprint.

But once an operator of Optum’s size commits to home health delivery, there’s no real reason to stop expanding after acquiring one or two providers.

It’s unlikely Optum will continue acquiring home health providers, as the Federal Trade Commission (FTC) at some point will step in and block transactions. The FTC took a closer look at the LHC Group deal, and that was before Optum had any Medicare-certified home health capabilities.

It is likely that Optum will enlist Amedisys and LHC Group leaders to find more quality home health care providers that could fill holes across the country.

Optum and UnitedHealthcare are mostly siloed wings of the UnitedHealth Group mansion. But if Optum could build out an expansive network of quality home health providers, it would undoubtedly benefit both entities.

UnitedHealthcare would gain incredible home health access for its patients, enabling it to lower post-acute care spend on its members. Optum, meanwhile, would further its value-based care initiatives, with an array of at-home care tools in its back pocket.

“To just say it directly, we want to partner with you,” Patrick Conway, the CEO of Care Solutions at Optum, said at the Home Care Innovation + Investment Conference in June. “How do we get this right? How do we have a home health system … that partners with Medicare Advantage plans, both United and others, to really have a value-based system in home health?”

For independent operators looking on, it may make more sense to join the Optum home health wave than to fight against it.

Amedisys’ future

LHC Group executives still talk about their pain points and ambitions as if they’re independent. At least for now, they see themselves as the large home health provider they’ve always been, and not just as one cog in a massive health care services system.

That could change.

If Amedisys joins Optum, it will be fascinating to find out if Amedisys and LHC Group will become one home-based care powerhouse, or remain co-existing counterparts under one roof.

There are things LHC Group does that Amedisys doesn’t, and vice versa.

“Assuming things go through and there’s not broad scale divestitures that are required for the deal to happen,” Tyler Giesting, a director at West Monroe, told HHCN last month. “They would really be back in a place where they’re managing a much broader sort of post-acute care continuum. … They would be re-adding personal care. Then we know that Amedisys has the Contessa arm, where they’re doing in-home complex acute care, as well as palliative care, which is an area that LHC Group, largely, is not in today.”

Contessa Health is a provider of high-acuity care services at home, as well as palliative care services. Over the last year, it has been portrayed as a differentiator for Amedisys by its leaders.

In February, Amedisys announced an agreement with BlueCross BlueShield of Tennessee to deliver home-based palliative care to the insurer’s millions of members, with Contessa being the driving force.

Optum could become a leader in hospital-at-home care overnight through Contessa Health. But there’s also a chance it divests Contessa Health and moves on with what it really wants out of Amedisys: its home health footprint.

Option Care Health’s path forward

Option Care Health will receive $106 million thanks to Amedisys’ choice to go ahead with Optum’s offer.

But even before Optum was in the mix, a source told me that it was “far from certain” that the company’s shareholders would approve the Amedisys deal. Even though adding Amedisys would have created a far more diverse payer mix for the company, home health payment rate uncertainty alarmed shareholders.

“We know that the reimbursement model will be changing over time and we’ve been thinking about what we need to do to provide broader services with that,” Option Care Health President and CEO John C. Rademacher said at the BofA Securities Health Care Conference. “We think that we have built [the reimbursement uncertainty] and an appropriate assessment of those types of changes into the model.”

The allure for Option Care Health was creating a value-based at-home care continuum. Therefore, its leaders did not see Medicare fee-for-service rates as cause for concern.

“No one’s knocking on our door saying they wanted to give us more money in the infusion space either,” Option Care Health CFO Mark Shapiro added. “We fight for every aspect of reimbursement to make certain that we’re fairly paid and we believe that there’s a compelling value proposition here to drive better outcomes for their patients.”

The Centers for Medicare & Medicaid Services (CMS) proposed another payment rate reduction for home health care agencies on Friday.

That could mean two entirely different things for Option Care Health. They could back away, given the fact that their shareholders’ fears over the stroke of the pen proved – in some ways – correct. It could be cause to back away from the home health sector for now until things stabilize.

But it could also be a chance to hop on an asset at what would be a bargain rate compared to just a couple of years ago.

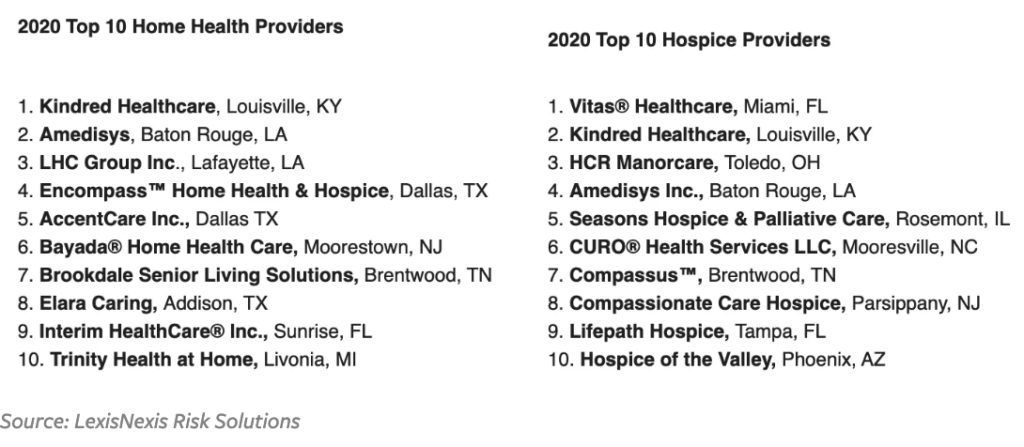

Target options are dwindling, however. Of the top 10 largest home health providers in 2020, nearly half are off the table.

Kindred, Amedisys and LHC Group have all been acquired, or agreed to be acquired. Brookdale Senior Living (NYSE: BKD) divested its home health segment to HCA Healthcare (NYSE: HCA).

Then, Bayada – while large – is a nonprofit and likely not a buyer’s target. Interim HealthCare is a diversified provider and franchised. Trinity Health at Home has too limited of a footprint.

That leaves the private-equity backed providers AccentCare and Elara Caring, as well as Enhabit Inc. (NYSE: EHAB), which spun off from Encompass Health Corporation (NYSE: EHC) last year.

All three of those providers would likely be willing to enter into discussions with Option Care Health. AccentCare and Elara Caring are nearing the end of their private equity backers’ holding periods.

Enhabit, meanwhile, has been urged by shareholders to consider a sale – especially in light of the Amedisys news.

“Given Enhabit’s objectively challenged execution and share price performance, the board should fully explore the potential delivery of substantial and fair value to shareholders through a sale of the Company,” AREX Capital – the owner of 4.5% of Enhabit shares – wrote in a letter sent to Enhabit’s board of directors last month.

Companies featured in this article:

AccentCare, Amedisys, Elara Caring, Enhabit Inc., LHC Group, Optum, UnitedHealth Group