This article is a part of your HHCN+ Membership

Whether it’s because of their proven leadership teams looking to shake up the market or their roles in a jaw-dropping transaction, there are several home health providers that stand out among their peers in 2023.

And the moves that these companies – new players and established powerhouses alike – make over the next 6-12 months will define the home health industry’s post-PHE identity for years to come.

In this HHCN+ deep dive, Home Health Care News makes the case for why six companies, in particular, are “providers to watch” in 2023. Other characteristics that make the organizations worthy of extra attention include their cutting-edge joint ventures, atypical payer strategies and forward-looking care models.

Amedisys

Baton Rouge, Louisiana-based Amedisys Inc. (Nasdaq: AMED) was already a home health company to watch in 2023 due to its ongoing investments in higher-acuity care, its use of predictive analytics and its new CEO, Richard Ashworth, who took over the top job in April. The provider solidified that standing on May 3, however, when it revealed plans to merge with Option Care Health Inc. (Nasdaq: OPCH) in an all-stock deal valuing Amedisys at about $3.6 billion.

Ashworth offered numerous reasons as to why the deal makes sense for Amedisys during a conference call that afternoon. But “the bottom line,” he explained during the call, is that Amedisys sees “tremendous upside from joining with Option Care Health” for patients, clinicians, payers and shareholders.

“We are confident that combining our expertise with Option Care Health will accelerate our ability to deliver on our mission to provide excellent patient outcomes and our vision to provide more clinical services,” Ashworth said. “This transaction also reflects the strength of our business and the great potential of care delivery in the home.”

Amedisys and its team of over 12,000 clinicians provides home health, hospice and higher-acuity care services in the home across 511 locations. The company serves over 455,000 patients a year, with annual revenues upwards of $2.2 billion.

With 163 locations and a staff of over 4,500 clinicians, the Bannockburn, Illinois-based Option Care Health is one of the biggest providers of home and alternate-site infusion services in the country. It serves more than 265,000 patients per year, with annual revenues exceeding $3.9 billion.

The merger between Amedisys and Option Care Health is expected to close in the second half of 2023. There’s no reason to believe the transaction won’t cross the finish line, considering UnitedHealth Group Inc.’s (NYSE: UNH) successful acquisition of LHC Group Inc. (Nasdaq: LHCG) early this year.

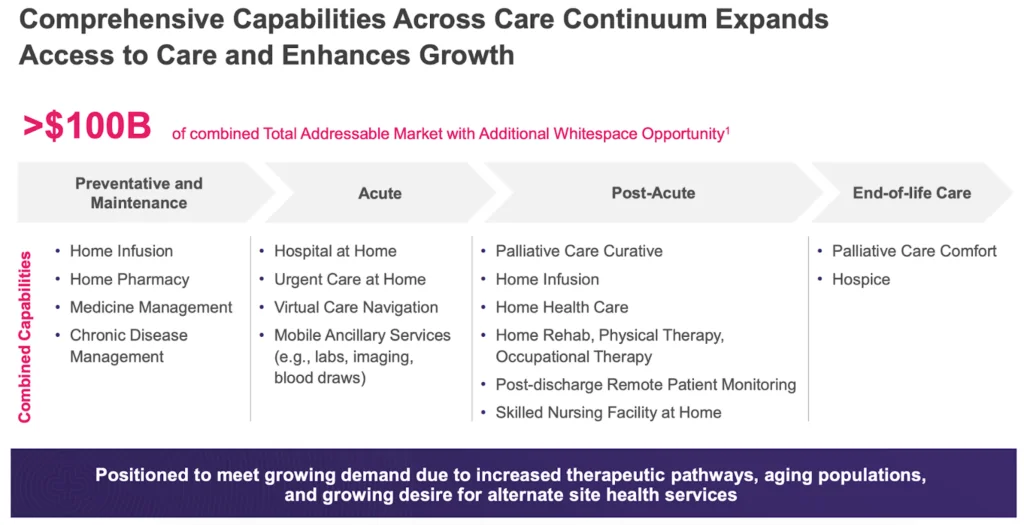

Once that happens, the combined Amedisys-Option Care Health will have a complementary set of end-to-end clinical capabilities, from preventative and maintenance services such as home infusion on one side, to end-of-life services such as hospice care on the other. In between, there will be mobile labs and imaging services, home-based urgent care, traditional home health, palliative care and more.

Together, the pair project a $100 billion total addressable market, with additional whitespace opportunity.

“There are ways for us to become more efficient and effective in the way that we’re addressing the needs of patients in the home,” Option Care Health CEO John C. Rademacher said during a recent investor presentation. “That’s a benefit for the patient. That’s a benefit for the payer. That’s a benefit for us from a capacity standpoint and being able to leverage and utilize the model in new and more efficient ways.”

Leading up to the transaction’s completion, it will be interesting to see how the deal impacts the rest of the home health market. It could kickstart strategic buyers’ interest in home health companies, while also setting a new valuation floor for Amedisys’ peers exploring a similar sale or combination.

Once the Amedisys-Option Care health merger is finalized, it will serve as a large case study to see whether an end-to-end platform can gain an advantage with payers and within value-based contracting agreements.

It will also be worth watching to see what happens to the quality C-suite, back-office and clinical leaders Amedisys has developed over the years. There are often redundancies in such transactions, meaning some top-tier talent might soon be searching for their next opportunity.

Compassus

The Nashville, Tennessee-based home health provider Compassus is a provider to watch in 2023 for a variety of reasons.

For starters, the company is another example of a highly integrated home-based senior care provider that also offers hospice and palliative care services, in addition to infusion therapy and advanced care management. In the past, the organization has also touted its cross-continuum partnership with non-medical home care franchise Synergy HomeCare.

Compassus was founded as a mostly hospice-focused company in 2006, though some of its parts go back to 1979. Its breadth and depth of services has helped accelerate growth, with the provider now operating at least 200 locations across dozens of states while appearing on Inc. 5000’s list of fastest-growing U.S. companies in 2021, 2018 and 2017.

Much of that growth is tied to consistent de novo and acquisition movement, with the landscape ripe for further expansion this year.

And while it hasn’t been as promotional as some of its competitors, Compassus – a founding member of the Moving Health Home advocacy group – has also invested mightily in higher-acuity care models, with its “SNF at Home” program allowing patients to recover at home when they need a level of care that’s between home health and an inpatient-facility stay.

“We’ve learned that we can use new tools and approaches to provide care in the home at a higher level of intensity, whether you think about skilled nursing care at home or hospital at home,” Compassus’ former CEO, Jim Deal, previously told HHCN.

Deal stepped down as CEO in January 2022, with DaVita Healthcare Partners veteran David Grams named his replacement.

Compassus is also worth following because of its two sponsors: private equity firm TowerBrook Capital Partners and health system Ascension Health. The pair acquired Compassus in 2019 at a valuation of $1 billion, according to PE Hub.

TowerBrook’s private equity funds invest in large and midsize companies across a range of sectors, both in the U.S. and Europe.

Meanwhile, with roughly $28 billion in 2022 revenue, Ascension Health is one of the largest nonprofit health systems in the nation. It offers home health services through its Compassus relationship under the branding of “Ascension at Home, Together with Compassus.”

Compassus remains firmly committed to building a platform capable of handling a variety of patients – and HHCN is eagerly waiting to see what it’ll do next.

“[What] we’ve learned in the past few years is we actually can do more clinically complex care at home,” Jennifer Hale, the VP of clinical quality and standards at Compassus, recently told HHCN.

“The burden on the provider community is to figure out how to close the gap between the things that are not necessarily considered part of health care, such as the social determinants, food security, access to medication, safety needs, mobility needs,” she continued. “Those things which make a person successful in their home.”

Frontpoint Health

Medicare Advantage (MA) now provides Medicare coverage for just over half of all eligible beneficiaries, according to U.S. Centers for Medicare & Medicaid Services (CMS) data. In January 2023, nearly 30.2 million beneficiaries were enrolled in an MA plan.

In comparison, less than one in five eligible beneficiaries were enrolled in MA in 2007. The staggering growth of Medicare Advantage, the private-plan alternative to traditional fee-for-service (FFS) Medicare, is linked to a number of factors, including the perks MA plans offer, lower out-of-pocket spending and an often easier consumer shopping experience.

Broadly, home health providers have historically skewed their payer mix more toward FFS Medicare, which tends to reimburse services at higher rates with less red tape. But as a bigger chunk of their patient population enters MA, providers have had to take more MA business to stay relevant.

This has led to financial losses and rocky MA relationships for many providers.

One emerging home health company, however, is basing its entire business model on Medicare Advantage. That’s Frontpoint Health, the Dallas, Texas-based provider backed by PE firms Cimarron Healthcare Capital and Tacoma Holdings.

“We want to approach home health and hospice in a different way,” Frontpoint CEO Brent Korte explained during an HHCN+ TALKS conversation.

HHCN photo

HHCN photoCurrently, Frontpoint has three home health and hospice locations in the DFW market. Unlike other providers that have had to pivot to a heavier MA business mix on the fly, Korte and his team are investing in people, processes and technology to thrive from the get-go.

“Many organizations are stuck,” Korte, who in his last role helped turn around the struggling home health arm of a Washington-based health system, continued. “They’re so large, and their processes have worked so well for traditional Medicare. Then you introduce a plan where they’ll make 30% or 40% as much on each patient, [and] it’s probably inconceivable that they would be able to restructure in a way that will allow them to take MA patients. Providers are having to deal with that because they’re having to change mid-flight. Our win is in the way we execute.”

Matt Komenda, founder and managing partner at Tacoma Holdings, echoed those sentiments at the HHCN Capital+Strategy Conference.

“We’ve built a go-to market strategy around that [MA] payer, because we’re deep believers that this is one of the biggest structural trends in our lifetimes within health care, and that we can’t fight against it,” Komenda said.

Moving forward, Frontpoint will help determine whether specialized, hyper-focused MA home health providers can truly take off.

LHC Group

LHC Group was founded as a single-site home health agency in Louisiana in 1994 by the husband-and-wife duo Keith and Ginger Myers. In fairly short order, that agency grew into one of the industry’s superpowers, with an active joint venture strategy, strong de novo growth and robust M&A activity propelling it forward.

As of early 2022, the Lafayette, Louisiana-based company delivered home health, hospice and home- and community-based care in over three dozen states via 527 locations. It boasted 82 unique joint ventures in March 2022, collectively covering upwards of 435 hospitals.

In past years, LHC Group could have been a home health provider to watch for its JV success, its somewhat unheralded accountable care organization (ACO) management business or its own higher-acuity care capabilities.

But in 2023, it’s a provider to watch because it’s under new ownership.

We will learn from and build upon LHC’s capabilities, expanding the scope and acuity of the care we can provide in a patient’s home.

– Dirk McMahon, president and COO of UnitedHealth Group

UnitedHealth Group (NYSE: UNH) and subsidiary Optum closed a $5.4 billion deal to acquire LHC Group in February. The transaction agreement was initially announced in March 2022.

“Since our founding in 1994, ‘It’s all about helping people’ has been the core of our mission, and as part of the Optum team and its value-based capabilities, we will be able to expand our patient-centered mission and help drive best care practices across the country,” Keith Myers, LHC Group’s chairman and CEO, said at the time. “Working together as organizations committed to caring for the most vulnerable in society will help us more effectively and efficiently deliver high quality and increasingly value-based care in the home.”

UnitedHealth Group reported total consolidated revenues of $91.9 billion in the first quarter of this year, a 15% year-over-year increase. Optum reported $54 billion in revenue, good for 25% year-over-year growth.

Adding LHC Group allows UnitedHealth Group and Optum to shift more services into the home while gaining clearer insights on the lives they manage. Doing so likewise gives the overall organization more firepower in its value-based care campaign, in which it’s gaining ground.

In Q1 2023, Optum covered roughly 4 million lives in fully capitated models, according to UnitedHealth Group leadership. That’s about double the number of lives it covered in value-based care contracts toward the end of 2021.

Now, LHC Group and Optum just need to explore how to maximize the home health provider’s skillset – and how LHC Group fits alongside Optum’s other care delivery assets. Those assets include, for example, comprehensive, in-home medical care company Landmark, which Optum acquired in 2021. They also include the parts of what was once Prospero Health, another home-based care provider with a palliative care focus.

“LHC provides high-quality, compassionate home health, hospice and post-acute care services, with over 12 million patient encounters each year,” Dirk McMahon, president and COO of UnitedHealth Group, said during the company’s first-quarter earnings call. “We will learn from and build upon LHC’s capabilities, expanding the scope and acuity of the care we can provide in a patient’s home.”

Additionally, it’s important to note that the largest employer of physicians in the U.S. isn’t one of the major health systems or primary care groups. It’s Optum, which has over 70,000 employed or aligned physicians across more than 2,200 locations in 2023.

Traditions Health

Traditions Health is another home health company to watch in 2023. The Nashville-based provider offers home health, hospice and palliative care services to more than 25,000 patients a year across more than 130 locations in 18 states.

Among the reasons it’s worth following: its track record of strong inorganic and organic growth, plus its continued investment in palliative care.

“We shifted our focus and started looking at de novos, looking at markets that are underserved, looking at relationships with systems, looking at relationships with facilities,” Traditions CEO David Klementz explained during an HHCN+ TALKS conversation. “We also started looking at the expansion of our lines of business into markets where maybe we only have one of the three, or two of the three – filling out that line of service in every market for the full continuum in the home.”

HHCN photo

HHCN photoBacked by Dorilton Capital Advisors, Traditions has been among the more active acquirers at times. In March 2022, for example, the company acquired five hospice entities in California and Nevada.

Tri-locating home health, hospice and palliative care is at the top of Traditions’ 2023 priority list.

“You’ve heard me talk about us being a home health system, and operating like an acute care system, and being professionalized like an acute care system,” Klementz told HHCN after speaking on a panel at the Capital+Strategy Conference. “It’s my belief that if you have a home health system that has that sophistication, competency and discipline, that you’ll be an outlier in the space.”

Palliative care is likely to become a more important part of home health providers’ business mix in years to come, especially as FFS Medicare margins shrink. Palliative care can often serve as a glue to value-based care arrangements, and alternative payment models are opening more doors for steady reimbursement.

Providers such as Traditions investing in palliative care now will have a leg up once the service becomes more mainstream.

VitalCaring

VitalCaring is the new home health company led by industry veteran April Anthony and her experienced leadership team, which also includes President Luke James, COO Chris Walker, Chief Clinical Officer Janice Riggins and CFO Jessica Vogt.

The Dallas-based provider is hiring aggressively, and it already has over 70 locations in six states, according to its website. More rapid growth is likely in store for VitalCaring, too.

“When we think about growth, it’s very much a three-pronged approach,” Anthony recently told HHCN. “We absolutely intend to be very active in the M&A space, we intend to be very intentional about our de novo expansion. And then we intend to be very honed in on true organic growth.”

As most home health insiders know, Anthony is the former CEO and founder of Encompass Home Health & Hospice, which eventually became part of Encompass Health Corp. (NYSE: EHC) before later spinning off into Enhabit Inc. (NYSE: EHAB). Since launching that successful business, Anthony has cultivated a reputation as a forward-looking operator with a profound understanding of what it takes to run a home health organization – from coding intricacies and clinical practices, to Medicare payment policy and value-based care.

In 2023 and beyond, it will be worth watching to see whether Anthony can take VitalCaring to a similar level of success.

“It is definitely reinvigorating [to be back],” Anthony told HHCN.

It’s not just VitalCaring’s leadership team that’s of note, however. It also has two health care mavericks as its PE sponsors: The Vistria Group and Nautic Partners.

On its end, Vistria has helped grow home health and hospice businesses such as Agape Care, St. Croix Hospice, Help at Home and Mission Healthcare. Its other health care portfolio companies include behavioral health companies BHG, Beacon Specialized Living and Sandstone Care.

Nautic’s active health care portfolio includes Integrated Home Care Services on the home-based care front, with behavioral health investments Nystrom & Associates and Pyramid Healthcare. All Metro Health Care is a past investment.

Companies featured in this article:

Amedisys, Cimarron Healthcare Capital, Compassus, Dorilton Capital Advisors LLC, Frontpoint Health, LHC Group, Nautic Partners, Option Care Health, Optum, Tacoma Holdings, Towerbrook Capital Partners, Traditions Health, UnitedHealth Group, Vistria Group, VitalCaring